Seventy-three percent of younger drivers were introduced to trucking through a family member in the industry

In July, the American Transportation Research Institute (ATRI) released a new report that investigates how to best integrate younger adults aged 18 to 25 into trucking careers.

A new rigorous Safe Driver Apprenticeship Pilot Program is going to take some of the under 21 intrastate drivers and train them so they can cross state lines.

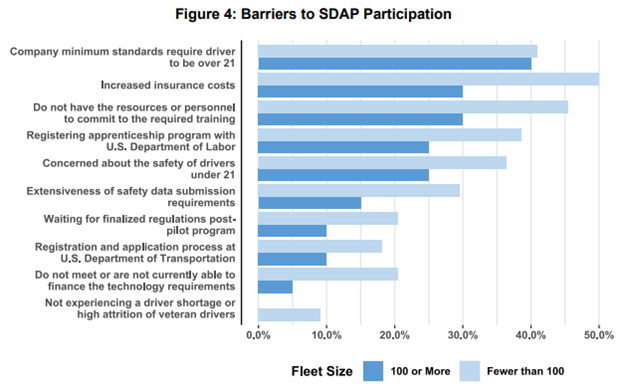

The ATRI research survey was designed to understand what barriers there are for fleets to participate in the pilot program. The survey generated responses from roughly 100 carriers that were categorized in 100+ fleet size or fewer than 100 fleet size.

The report says that “while many in the industry support the expansion of interstate CMV driving for individuals under the age of 21, many carriers are not yet prepared to hire younger drivers.”

But why?

While some carriers expressed concern about the safety of drivers under 21 (36% of small fleets and 25% of large fleets) other non-safety issues are more common.

According to the report, the most frequent factor that has a significant impact on carriers’ decision not to participate in the Safe Driver Apprenticeship Program (SDAP) is “official company policy requiring drivers to be older than 21”. These policies, however, reflect other practical concerns.

So, what is the biggest concern?

“Increased insurance costs represent a significant barrier to participating in the SDAP and eventually hiring younger drivers.” The report found that half of small fleets and 30% of large fleets cited this as a significant factor in their decision.

While government and industry association officials can address some of the concerns in the report, other concerns, like insurance costs and technology costs, depend on a carrier’s need and willingness to invest in younger drivers.

These costs can be significant, so carriers should take steps to understand younger drivers’ work perspectives and best practices for integrating younger employees to optimize outcomes.

If you are a carrier looking to hire younger drivers, or be a part of the SDAP, know that younger drivers asserted that greater transparency would help attract younger drivers. Their suggestions included making job postings more explicit about expectations or requirements and posting “day in the life” videos or other content to help convey a sense of what a job in trucking is like.

How to keep insurance rates lower for younger drivers

Every insurer has different eligibility requirements, just ask more questions of your brokers or insurance providers, because some will insure young drivers that others will not.

Also, do your due diligence to make sure you are hiring the best of these younger drivers by:

- running a thorough background check

- verifying employment history and references of all potential hires, and

- looking for drivers with clean driving records with no more than two minor violations in the past three years

In most cases, self-insured mega fleets will be the one hiring these young drivers since they can afford any driver risk.

After the young drivers complete the new rigorous Safe Driver Apprenticeship Pilot Program, they will be able to drive by themselves until they turn 21 but under continuous monitoring by trucking companies, including monthly safety performance reports filed with FMCSA.

This program should give these drivers the experience needed so that insurance coverage for the younger drivers is not unaffordable.

7 STEPS START AND RUN A SUCCESSFUL TRUCKING COMPANY

The worry is if minimum insurance premiums are raised from $750,000 to $2 million, as is being discussed federally. This will cause smaller fleets and owner operators to potentially close or will never be able to afford hiring these younger drivers.

Need an Insurance Quote?

Allow one of our Commercial Trucking Insurance Specialist to pull multiple insurance quotes for you to find the best rates.

It never hurts to get a quote and try saving money on your insurance premiums.

Give us a call anytime and we can discuss lowering your premiums or getting a quote to see where you stand.

Before we can get you an estimate, we are going to need some information.

Fill out a complete quote or quick quote to get started.

If you have any questions or concerns, please call us at 800.724.5523 or email info@cnsinsures.com.