The widely held belief that commercial drivers under the age of 25 cannot be insured is a myth, but it will be expensive.

A new rigorous Safe Driver Apprenticeship Pilot Program is going to take some of the under 21 intrastate drivers and train them so they can cross state lines.

The FMCSA will issue a specific exemption to the normal age restrictions for each young driver admitted to the program, which will run for up to three years and complete a report to Congress analyzing the safety record of the teen drivers and making a recommendation on whether the younger drivers are as safe as those 21 or older.

But the question that continues to come up is who will insure these drivers?

FREE GUIDE | 7 Steps To Start and Run A Successful Trucking Company

Myth: “I can’t insure a driver under the age of 25”

According to comments submitted by the Owner-Operator Independent Drivers Association (OOIDA), “We expect it will be difficult for many motor carriers to afford insurance coverage for younger drivers. Small-business motor carriers are especially unlikely to take the risk of insuring under-21 drivers without evaluating the costs and benefits to their operations. In all likelihood, only self-insured carriers will be willing to provide coverage for under-21 interstate drivers.”

This belief often stems from data that places young drivers in a negative light. For example, in 2017 individuals under the age of 24 years represented 18.4 percent of drivers involved in fatal crashes while representing just 11.8 percent of the licensed driving population that year.

While this statistic seems like a warning for younger drivers and insurance providers, the widely held belief that commercial drivers under the age of 25 cannot be insured is a myth, but it will be expensive.

In fact, self-insured mega fleets will be the ones hiring the young drivers since they can afford any driver risk, but it will further their driving experience.

Why is it a myth? Well, these statistics need to be compared to other age groups in the industry. Are younger drivers really that bad?

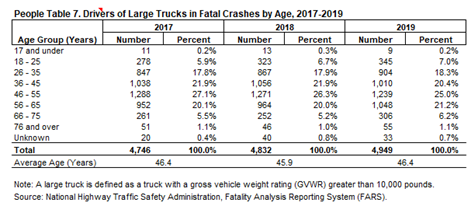

The FMCSA reports, “Of the 4,949 drivers of large trucks involved in fatal crashes in 2019, 354 (7.2%) were 25 years of age or younger, and 361 (7.3%) were 66 years of age or older.”

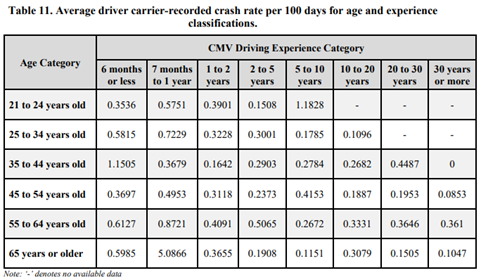

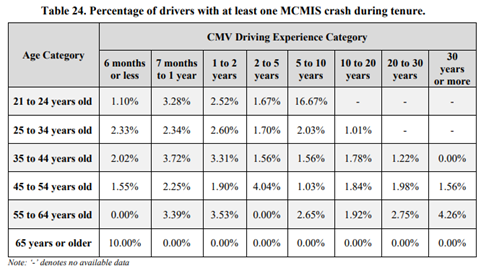

Additionally, while some might think that age is the bigger factor in determining risk, as it does with determining insurance rates for non-CDL drivers, a recent study found that experience in big rigs was the dominating factor.

The more than 9,000 participants were asked to complete a questionnaire that included questions on the driver’s age and CDL driving experience. Their answers were cross-referenced with driver safety performance metrics from the Motor Carrier Management Information System (MCMIS), as well as carrier-recorded crash data and the Commercial Driver’s License Information System (CDLIS).

The data showed that “for drivers with seven months to one year of CMV driving experience, crash rates were higher for drivers aged 55 years and older compared to their younger counterparts.”

How will the trucking industry measure young driver safety risk?

ATRI, American Transportation Research Institute, released results of the Phase 1 Beta Test of its Younger Driver Assessment Tool which is meant to explore if it is even possible for an assessment tool to identify the safest 18-20 year old drivers.

The beta test findings for the Younger Driver Assessment Tool provided limited support for the idea that low risk commercial truck drivers can be identified based on behavioral indicators in their Motor Vehicle Record (MVR) and Pre-Employment Screening Program (PSP) safety records.

In general, and counter to expectations, cognitive functioning was not reliably associated with histories of violations or crashes in the group of 16 drivers used during initial testing.

With expanded statistical validation, this methodology may be successfully applied to the assessment and selection of new entrants into the industry’s workforce, including younger drivers.

Ultimately, the goal of the assessment tool would be to secure younger drivers with the cognitive and mental attributes of mature, experienced drivers, which based on data implies that they are more likely to be safe drivers.

ATRI’s Phase II assessment will focus on a larger sample of young drivers by recruiting individuals in the 18- to 25-year-old age range from commercial driving schools.

How to keep insurance rates lower for younger drivers

Every insurer has different eligibility requirements, just ask more questions of your brokers or insurance providers, because some will insure young drivers that others will not.

Also, do your due diligence to make sure you are hiring the best of these younger drivers by:

- running a thorough background check

- verifying employment history and references of all potential hires, and

- looking for drivers with clean driving records with no more than two minor violations in the past three years

In most cases, self-insured mega fleets will be the one hiring these young drivers since they can afford any driver risk.

After the young drivers complete the new rigorous Safe Driver Apprenticeship Pilot Program, until they turn 21, they will be able to drive by themselves but under continuous monitoring by trucking companies, including monthly safety performance reports filed with FMCSA.

This program should give these drivers the experience needed so that insurance coverage for the younger drivers is not unaffordable.

The worry is if minimum insurance premiums are raised from $750,000 to $2 million, as is being discussed federally. This will cause smaller fleets and owner operators to potentially close or will never be able to afford hiring these younger drivers.

Need an Insurance Quote?

Allow one of our Commercial Trucking Insurance Specialist to pull multiple insurance quotes for you to find the best rates.

It never hurts to get a quote and try saving money on your insurance premiums.

Give us a call anytime and we can discuss lowering your premiums or getting a quote to see where you stand.

Before we can get you an estimate, we are going to need some information.

Fill out a complete quote or quick quote to get started.

If you have any questions or concerns, please call us at 800.724.5523 or email info@cnsinsures.com.