With the rise in fuel costs, supply chain issues, and the risk of uncontrollable inflation, trucking saw a 12.7% increase in average operation costs, hitting $1.855 per mile, the costliest year to date.

Though fuel saw the single largest jump in expense and made up 50% of the increase in costs, nearly every other line-item cost center grew or remained constant.

However, several indicators in the commercial insurance industry point to a window of relief in insurance premium increases for motor carriers.

What the ATRI report says about trucking insurance premiums

According to the recent ATRI Operational Cost of Trucking report, average insurance premiums decreased slightly.

Insurance costs for small carriers came down from the high 2020 levels, while private carriers saw a large decline in insurance premiums per mile. However, this decline – from 11 cents in 2020 to 8 cents in 2021 – brought their average closer to that of for-hire carriers.

This coincides with data from a Fitch Ratings report in June where, for the first time in a decade, the commercial auto insurance sector posted an underwriting profit in 2021.

Fitch Ratings also attribute improved profitability in the sector to corrective pricing, higher deductible requirements, and more disciplined underwriting standards; for these reasons, they stipulate similar results for 2022.

“Commercial auto renewal premium rates have risen for 43 consecutive quarters, however, the rate of increase fell to 5.9% in 1Q22 versus 9.0% in 1Q21, with 2022 pricing expected to flatten further.”

Earlier this year, ATRI’s report on The Impact of Rising Insurance Costs on the Trucking Industry shows that insurance premiums rose across all sectors and fleet sizes between 2018 and 2020.

Premiums rose despite motor carriers paying less in total annual out-of-pocket incident costs, having fewer incidents, and implementing on average three new safety technologies in these three years alone.

This research also identified a silver lining: carriers that took on more direct risk were successfully incentivized to reduce crashes and out-of-pocket costs. In 2021 these trends possibly helped lead to a stabilization in commercial auto liability insurance premium costs at 8.6 cents per mile, down one tenth of a cent from 2020.

While it is likely that insurance premiums per mile will increase again over the next year, in the short-term average increases will be moderate to low among carriers with consistent crash rates.

Crash rates and litigation

According to the latest ATRI report, concerns about rising crash severity nonetheless remain, especially amid the continued return to pre-pandemic traffic levels.

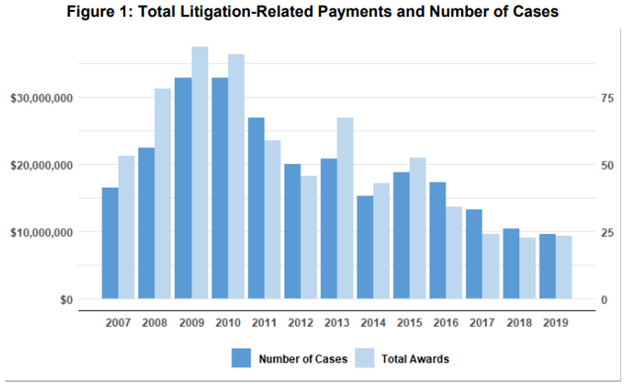

Though concerns stay high, litigation-related payment peaked in 2008 at $557,271, which is approximately 94 percent higher than the smallest average annual payment size of $287,347 in 2017. In addition, 2009 and 2010 saw the highest number of cases, both at 82, compared to less than 25 cases/year in 2017, 2018 and 2019.

While the data is hard to track, the decline in the number of cases in the sample may be attributed to the shift in average annual payment size to over $1M or to data availability and data collection methods rather than a true decline. One insurance industry professional, however, noted a recent decline in the incident per truck rate (crashes per 100 trucks).

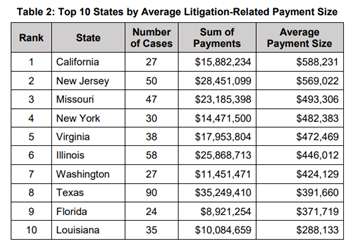

Insurance costs were highest in the Southeast, where they were almost one cent per mile higher than the national average. Several of the most litigious states in the country are located in the Southeast.

The Southeast also had the highest driver benefits costs per mile, followed by the Southwest.

How we keep trucking insurance rates down

The worst situation to be in is getting bad commercial truck insurance coverage and being committed to it for a year when one accident can ruin your business.

We recommend you start a custom quote online or call us directly to speak with a licensed trucking insurance professional.

We also assist trucking companies and haulers of all types with the necessary compliance advice that comes with owning a trucking company.

Our sister-company, Compliance Navigation Specialists, is an industry leading compliance company that will help keep you in compliance and commercial insurance rates low.

Their DOT Compliance Specialists are well-versed in the FMCSA rules and regulations and offer a number of services for you.

A PSM DOT Essentials Program is designed to keep motor carriers compliant with the basic DOT regulations that nearly all carriers must follow.

For more information, contact CNS at 888.260.9448 or info@cnsprotects.com.