Distracted driving is a major issue among all types of drivers but is an especially important concern for commercial motor vehicle drivers as it can lead to accidents, injuries, death, or excessive property damage.

What is distracted driving?

A driver is considered distracted anytime their full attention is not on driving.

These days the number of distractions that drivers are exposed to are endless and can include things like talking or texting on cell phones, CB radios, AM/FM radios, eating, daydreaming, other drivers and so much more.

Since underwriters look at many different risk factors to determine your insurance score, it is understandable that distracted driving is one of them, as it can be a major cause in other risk factors.

Underwriters can find distracted driving safety issues in many areas, such as traffic violations or accident reports found on your Motor Vehicle Record.

How to protect yourself from truck accident litigation with compliant driver files

However, it is not just your safety history that affects your insurance rates.

Drivers are at-fault for most vehicle accidents

Before we dive into the safety history of other drivers, let’s discuss the importance of distracted driving.

When it comes to accidents, distracted driving can be the most common cause.

The list below covers the top 10 reasons a driver may have caused an accident:

- Driving too fast for conditions (23%)

- Unfamiliar with roadway (22%)

- Over-the-counter drug use (legal) (17%)

- Inadequate Surveillance (14%)

- Fatigue (13%)

- Pressure from motor carrier (10%)

- Illegal Maneuver (9%)

- Inattention (9%)

- External Distraction (8%)

- Following too close (5%)

The issue is that distracted driving causes slowed perception of certain traffic events, which in turn leads to a delayed reaction. Slowed reaction times can lead to poor driver involvement, such as incorrect steering inputs, too much brake pressure or even inaccurate accelerator pressure.

Driver distractions can be physical, mental, or visual distractions.

A physical distraction is one that causes you to either take your hands off the wheel or take your eyes off the road. There are several things that can divert your attention including, handling the radio, eating, using your phone for texting, talking, taking pictures, or even searching the internet.

A mental or cognitive distraction is anything that takes your mind off the road. This could include having a conversation with a passenger, stress, anxiety or even daydreaming.

A visual distraction is anything that causes the driver to remove their eyes from the road, which could include texting or looking at things along the road as they drive, like billboards or animals. Visual distractions can take a driver’s focus away from potential roadway hazards such as pedestrians, cyclists, or even driveways where other vehicles might be entering the road.

Any combination of physical, mental, and visual distractions only increases the chances and severity of accidents, which is why it is so important to avoid all distractions.

As a commercial motor vehicle driver, you are operating a massive piece of machinery that can do an excessive amount of damage once you have lost control.

Other drivers’ distracted driving history can impact your rates

While distracted driving can be a very personal issue that you can control, professional drivers share the road with many other people.

Trucking is dangerous because drivers must deal with other distracted drivers, crumbling infrastructure, and congested roads across the U.S.

Underwriters use road safety data that highlights the more dangerous roadways in order to map out which states, metropolises, and cities are the riskiest to travel in.

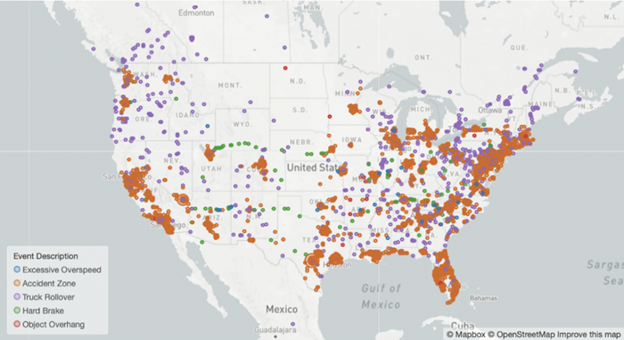

For example, in their live map of the U.S., Omnitracs data shows the most dangerous locations for commercial vehicles based on aggregated customer and third-party data, which are in the Mid-Atlantic, Northeast, Florida, and Texas.

Distracted driving is a major cause of these dangerous locations and underwriters know that drivers are more likely to exhibit high-risk driving behaviors in these areas.

Letting your underwriter know the safer routes your drivers frequently travel will help you reduce your overall risk and insurance rates.

Tips to lower your trucking insurance risk history

Maintain a clean driving record: While mistakes can happen, new carriers should do everything possible to keep their driving record clean.

Be sure to practice defensive driving habits to reduce the likelihood of vehicle accidents or speeding.

A handheld violation is one of the worst violations you can have on your record because you are not paying attention.

Check your motor vehicle record: The records underwriters have access to are an important part of how you are rated. Be sure to pull your motor vehicle record (MVR) at least once per year to check that it shows the correct information and always challenge incorrect information.

An annual review of the driver is required by the FMCSA and must include an updated MVR. Similarly for the FMCSA, review the violation history found in the federal MCMIS database that generates safety measurement scores and PSP reports.

If there is incorrect or duplicated information on record, carriers can use the DataQ process to request the removal or correction of violations incurred during roadside inspections.

Let CNS Insurance pull multiple insurance quotes for you to find the best rates

It never hurts to get a quote and try saving money on your insurance premiums. Give us a call anytime and we can discuss lowering your premiums or getting a quote to see where you stand.

Before we can get you an estimate, we are going to need some information.

Fill out a complete quote or quick quote to get started.

If you have any questions or concerns, please call us at 800.724.5523 or email info@cnsinsures.com.