Last year saw a demand for carriers delivering goods after the COVID-19 pandemic led to increased online shopping, a steady need to keep grocery stores stocked, and the need to deliver emergency supplies across the country.

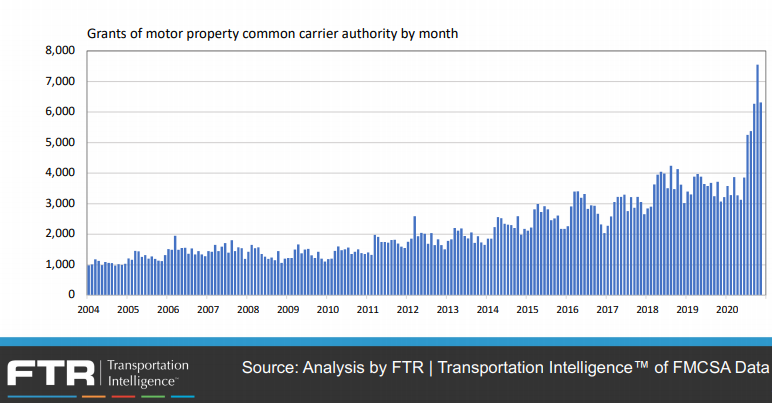

This led to a record 59,000 authorities being applied for by new motor carriers in 2020. As we ease out of pandemic, online shopping is likely to stay at record levels, businesses are stocking back up as demand increases, and drivers are getting out of the independent contractor mess to go on their own.

This is evident in that around 51,000 motor carriers have already received carrier authorities through June, increasing the likelihood that 2021 will surpass last year’s record.

Avery Vise, FTR’s vice president-trucking, who presented findings during a company webinar last week, said “the applicants were not driver newbies, but company drivers who have gone out on their own or owner-operators that had been working under a lease arrangement with larger carriers but became fully independent either voluntarily or after being cut loose during 2020 when the COVID-19 pandemic shut down much of the nation’s economy.”

While many of these new carriers have driving history, going on their own brings a new set of complications to become successful.

As we have discussed in previous articles, new trucking businesses fail due to lack of planning, lack of attention to variable costs like maintenance or food costs, low cash-flow, no collection strategy, failure to stay compliant, no knowledge of market rates, and no professional help.

As a new carrier in your first 2 years of business, your safety history will be held under a microscope before your insurance rates are reduced and maintaining a clean driving record while following DOT regulations is of upmost importance.

If you are one of these new carriers, or looking to go on your own, before getting insurance you will need to make sure you gather all the necessary licenses, authorities, and registration requirements for the types of loads and areas you plan to haul.

Now you are ready to obtain the correct insurance for your company. There are different types of insurance available and are often required to cover certain aspects of your trucking company.

Learn more about trucking insurance basics when getting started.

Once you receive your insurance and you are on the road, new carriers need to keep their rates down by staying in compliance with the many federal and state rules governing your business.

Our partner, Compliance Navigation Specialists, is an industry leading compliance company that will help keep you in compliance and commercial insurance rates low.

Their DOT Compliance Specialists are well-versed in the FMCSA rules and regulations and offer a number of services for you, including but not limited to:

Let CNS Insurance pull multiple insurance quotes for you to find the best rates

It never hurts to get a quote and try saving money on your insurance premiums. Give us a call anytime and we can discuss lowering your premiums or getting a quote to see where you stand.

Before we can get you an estimate, we are going to need some information.

Fill out a complete quote or quick quote to get started.

If you have any questions or concerns, please call us at 800.724.5523 or email info@cnsinsures.com.