If you have been a carrier for a while, then you know that your company’s loss-run history is important when renewing or shopping for insurance.

Insurance companies use your loss history to see how risky you are to insure, affecting the premium you could end up paying.

In other words, if you keep a clean loss-run history, you could see better rates.

We will help you understand:

- what a loss-run history report looks like,

- how to request the report, and

- how to keep losses down.

What is a loss-run history report?

Loss-run reports are a history of any claims your business has had while you have been in business or insured.

Simply, the report gives you and potential insurers a clear picture of your experience, how well you operate your business, and the degree of risk associated with insuring your company.

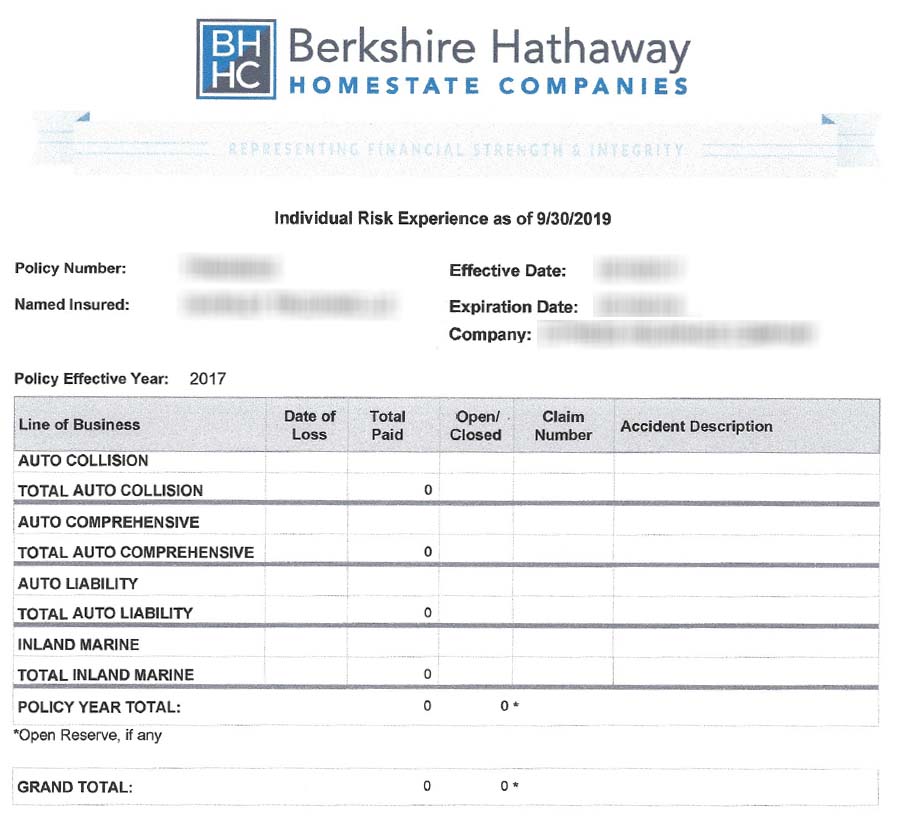

The report includes:

- insurance provider

- policy number

- date of each claim

- amount paid or on reserve, and

- brief description of the claim

If there is a claim, each one is listed on its own line, and the report will specify whether each claim is open or closed.

FREE GUIDE | 7 Steps To Start and Run A Successful Trucking Company

If you have had coverage with more than one insurance company, then you will need to request a loss run from each of these providers.

Why loss-run history is important to underwriters

Underwriters take a lot into account when looking at loss run reports, such as total claim occurrences, total loss amount, average amount of each loss, and how many miles the carrier has per loss.

A carrier that has 2 losses but runs 2 million miles is looked at a lot more favorably than a carrier with 2 losses and only has 100K miles.

The severity of a loss can also reflect a one-time catastrophe or signal a big problem in your business operations.

For example, frequent claims on the report could signal issues with your maintenance schedule, business practices, or manufacturing process.

Tip: To prevent the underwriter from making any assumptions, provide an explanation of the loss activity.

“If you’ve been in the trucking industry for even a short amount of time you know insurance is expensive but one thing you might not know of is Loss-Run reports and how they affect your rates.”

Ron Haws

Most underwriters ask for a 3-to-5-year loss run history or, for newer carriers, however long your company has been in business.

They may also ask for the last 4 quarters of IFTA reports to show what states you operate in.

Tip: Your total incurred claims should not be more than the amount you paid for coverage in any given year.

Insurance companies usually price what they view as the best-performing carriers at two times the expected or average annual claim costs.

For those they believe to be poorer performing carriers, the costs are often three to four times the expected or average annual claim costs.

How to Request a Loss Run Report

You can either download the report through your current insurance provider’s online portal, or call/email your agent to ask for a report.

When asking for a report, be sure to provide:

- the name the policy is insured under

- the policy numbers, and

- the number of years or policy periods for which you are seeking a history

It is important to note that the agents on record typically are the ones to obtain the loss runs and they do not want to lose you as a client. Oftentimes when you ask for a report, they purposely delay getting the loss runs out so you cannot shop around.

Tip: Obtain your prior year’s loss run history on an annual basis so you have it available when you want to shop your policy around.

In most states a company is legally required to provide your loss runs within ten business days.

Best practices to keep loss run claims down

Accidents will inevitably happen, but proactive safety is vital in proving you are taking safety precautions to prevent accidents from happening.

Generally, trucking companies with minimal loss activity, utilizing telematics data, and great CSA scores are in a better position to gain access to more insurers with better pricing.

Below are tips to lower your trucking insurance risk history:

- Maintain a clean driving record: While mistakes can happen, new carriers should do everything possible to keep their driving record clean. This means practicing defensive driving habits to reduce the likelihood of vehicle accidents or speeding. For example, do not use a handheld device while driving. Utilize Bluetooth capabilities or hand-free options, pay attention to work and school zones and their reduced speeds, and park in legal parking areas for large trucks. The severity of the violation makes a difference and handheld violations are up there. It is also important to pull your motor vehicle record (MVR) at least once per year to check that it shows the correct information and always challenge incorrect information.

- Implement a proactive driver training program: Training your drivers on conducting a proper pre-trip and post-trip inspection is as important as teaching them how to drive the truck. Some of the easiest things to catch during a driver inspections are also the most common violations written up on a roadside inspection. Violations and accidents are the quickest ways to increase your insurance premiums to unaffordable heights.

- Use ELD telematic data to improve safety: This goes hand in hand with proactive driver training.Any driver red flags can immediately trigger video training schedules related to defensive driving, fuel efficiency, HOS regulations, driver ELD training, or whatever topic they are having real-time issues with.

- Build good credit history: A higher credit score means a better rating. The theory with credit is that if you manage your personal financial affairs well, you are more likely to take your driving and safety seriously. Be sure to pay your bills on time, including mortgages or rent, credit cards, auto insurance, and car or truck payments. Another way to keep your credit score high is to make sure your credit utilization rate is below 30%, if possible. For example, if you have a credit card account with a $10,000 limit and a $5,000 balance on the card, your credit utilization rate is 50%. This means making sure you pay down any credit to below 30% of your total credit limit available to you. Another option is to ask for your credit card limit be increased on a card or two to make the credit utilization rate lower quickly.

- Follow DOT compliance rules: All carriers will eventually have to deal with DOT roadside inspections, DOT compliance checks, and DOT safety audits. Be sure to follow all hours of service, drug testing, licensing, and safety requirements set by the FMCSA.

- Have a written safety policy: Written safety policies detail how you handle accidents, drug and substance abuse, and other safety-sensitive issues and can be a key to telling your safety history and lowering truck liability insurance premiums. The best place to start is showing proof of documented safety policies for drivers and managers as well as proving that they are being followed, such as documenting completed training as more training equals a better safety profile.

Need a Commercial Truck Insurance Quote?

The worst situation to be in is getting bad commercial truck insurance coverage and being committed to it for a year when one accident can ruin your business.

We recommend you start a custom quote online or call us directly to speak with a licensed trucking insurance professional.

Before we can get you an estimate, we are going to need some information.

Fill out a complete quote or quick quote to get started.

If you have any questions or concerns, please call us at 800.724.5523 or email info@cnsinsures.com.