The Annual Insurance Review is one of the most neglected tasks by trucking companies, which can lead to very costly trucking insurance coverage gaps.

Taking into account the constant fluctuation of freight rates and driver turnover, when was the last time you had an Annual Insurance Review with a professional insurance agent to discuss the changes in your operation, equipment, personnel, and radius of operation?

Insurance is the fourth largest cost for carriers, so taking the time to review your insurance policy and understanding what to look for when receiving multiple quotes needs to be a priority..

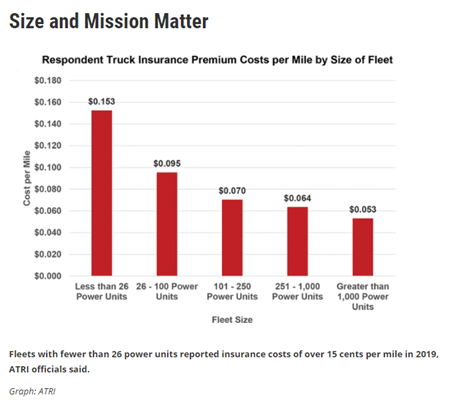

ATRI’s latest annual Operational Costs of Trucking report, issued in November, shows that truck average insurance premiums were 6.8 cents per mile in 2019, with carriers under 26 power units averaging 15.3 cents per mile.

While this is a decrease over the previous year, many trucking fleets are assuming higher risk levels through higher deductibles, self-insurance, expanding use of insurance captives, and lower levels of excess liability coverage.

Asking the right questions in an annual insurance review can be the difference of thousands of dollars or even keeping your company alive and can help you determine the right time to change your commercial trucking insurance.

When is the right time to switch Commercial Trucking Insurance?

Questions to discuss in an annual insurance review

Annual insurance reviews should happen several months before current insurance coverage expires so you can plan for the best type of coverage and give time to receive multiple quotes.

Make sure you do not jeopardize your success by cutting corners on insurance. Assess whether you have any gaps in your coverage and address those concerns when getting quotes for a new commercial trucking policy.

Important questions to ask that will help you uncover trucking insurance gaps include:

Is my fleet growing?

Each time you add a truck you should revisit your insurance coverage to add that truck to the policy and see if you qualify for any multi-truck discounts. Fleet discounts can save you a lot more money on coverage overall than if you were to go with the lowest quote on insurance for another single truck.

Have I changed the type of cargo being hauled?

Different types of cargo possess different hauling risks. While most carriers end up with $300,000 of cargo coverage, there can easily be gaps in coverage.

If you have changed or added the types of cargo you haul, it is important to find out the cost of that new cargo and make sure the cargo and/or hazmat insurance covers your freight.

If you do not have a broad form cargo policy, be sure you know exactly what loss scenarios are not covered.

Is your fleet focused on specific driving routes?

How many different driving routes do your drivers use? The more regular routes you operate in, the more familiar your drivers are. Insurance companies are big fans of regular routes as it lowers the overall risk in an accident.

What is and is not covered in my insurance policies?

If you have your own authority, your truck insurance policy requires liability insurance. The minimum amount required is $750,000, but many truckers choose $1,000,000 in coverage.

You should ask your truck insurance agent to walk you through your limit options. While a million in liability may sound high, trucks can cause a lot of damage, even if it is not your fault. Discuss the benefits and costs of an umbrella policy to protect you in the event of a catastrophic loss.

What are the main factors driving my premium?

Insurers base risk on several factors, such as your age, driving record, credit rating, criminal record, area of operation, years of experience, what you are hauling, age of equipment, garaging zip code, and more.

If your quote is high, ask why. You can take steps to fix it when you renew the next year.

This may include hiring only experienced drivers with at least 2 years of CDL experience or reviewing your DOT safety record and fixing gaps in your safety plan as the number of unsatisfactory vehicle and driver inspections will increase your pricing and/or coverage options.

What are your payment plan options?

Most insurance companies offer several options for payment such as making monthly installments rather than paying it all in one lump sum.

However, you can lower your overall insurance premium by about 10% if you can pay the annual premium in one shot. A down payment with monthly installments will cost more.

If there is an accident, how much will my insurance policy pay?

This is important to know if you want to ensure that you are adequately covered. Do you have enough cash on hand to cover that deductible?

You may decide to take a higher deductible to lower your premiums, but you need to understand that this will also reduce the amount you are paid in the event of an accident.

How to Switch Policies

It never hurts to get a quote and try saving money on your commercial truck insurance premiums. Give us a call anytime and we can discuss lowering your premiums or getting a quote to see where you stand.

Before we can get you an estimate, we are going to need some information.

Fill out a complete quote or quick quote to get started.

If you have any questions or concerns, please call us at 800.724.5523 or email info@cnsinsures.com.