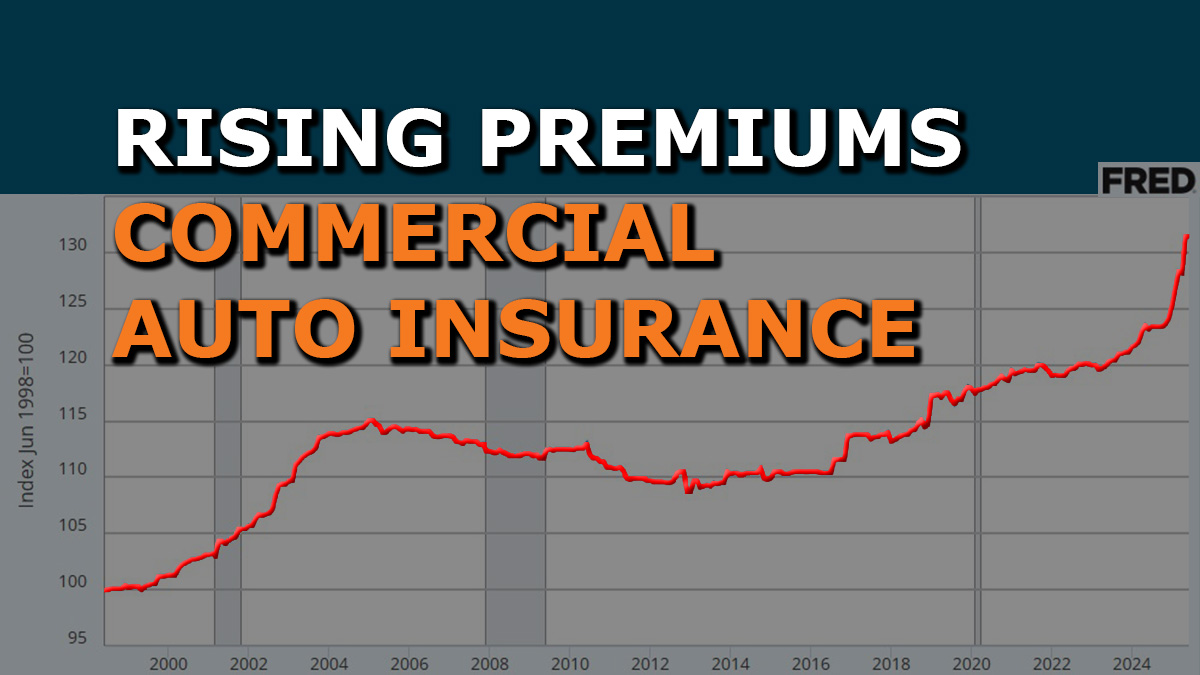

If you’re in the trucking industry, you’ve probably noticed it’s getting more expensive to stay insured. Whether you’re running a single truck under your own authority or managing a small fleet, commercial auto insurance premiums are hitting record highs — and there’s no quick relief in sight.

The question is: Why are rates climbing so fast, who is feeling the squeeze the most, and how can you take control of your insurance destiny?

Why Premiums Are Rising

Commercial vehicle insurance generally covers three main areas:

- Cargo Coverage – protects the load you haul.

- Auto Liability – covers injury or property damage to others.

- Physical Damage – covers your truck and equipment in an accident.

Most carriers carry $1 million in auto liability per vehicle — well above the federal minimum of $750,000. Auto liability has historically been a loss leader for insurance companies, meaning they expect to pay out more in claims than they make in premiums.

To offset these losses, insurers often make up revenue on other lines like physical damage coverage. So, what is driving up insurance premiums?

Key drivers of premium increases:

- Inflation in Equipment & Parts

- The cost of new trucks, used equipment, and replacement parts has skyrocketed. Underwriters are pricing policies with the expectation these costs will rise even further — especially with potential tariffs on parts from Mexico and Canada looming.

- Litigation & Nuclear Verdicts

- Multi-million-dollar jury awards against trucking companies grab headlines, but even smaller settlements have ballooned.

- Example: A broken leg with lost wages might have cost $80,000 in 2017; today, it’s more like $300,000–$400,000. SOURCE

- Multi-million-dollar jury awards against trucking companies grab headlines, but even smaller settlements have ballooned.

- Higher Medical & Repair Costs

- Hospitalization costs, vehicle replacement values, and lost income payouts have all increased, raising the dollar amount insurers must cover.

Who’s Being Hit the Hardest

- Small Fleets – With less negotiating power, they’re more exposed to market-wide premium hikes.

- Owner-Operators with Authority – Seen as higher risk due to lack of large-scale safety data, earning insurers only $10,000–$15,000 in annual premiums, which makes each claim more significant to their loss ratio.

- Carriers with Poor CSA Scores – Even minor violations can quickly put a carrier into the “high risk” category for underwriters.

Related: Bad Scores: Difference Between CSA Scores, Roadside, Audit and How to Fix Them

The Owner-Operator Challenge

Owner-operators, especially new authorities, face an uphill battle:

- Limited number of insurers willing to cover them.

- Older equipment may require inspections or be uninsurable with certain providers.

- Freight type, length of haul, and operating states all influence rates.

Reality Check: Even with spotless driving records, startup owner-operators should budget for significantly higher premiums in their first years of operation.

How to Manage Risk and Improve Your Loss-Run Profile

Your loss-run report is your insurance resume. It shows your claims history over the last 3–5 years and directly impacts how underwriters view your risk.

Underwriters take a lot into account when looking at loss run reports, such as:

- Total claim occurrences

- Total loss amount

- Average amount of each loss

- How many miles does the carrier have per loss

Example: Carrier has 2 losses but runs 2 million miles is looked at a lot more favorably than a carrier with 2 losses and only has 100K miles.

The severity of a loss can also reflect a one-time catastrophe or signal a big problem in your business operations.

Here are some ways to manage risk and improve your loss-run profile:

1. Keep a Clean Driving Record

- Avoid speeding (especially 15+ mph over), distracted driving, and at-fault rear-end collisions.

- A clean MVR over multiple years is one of the strongest signals to insurers that you’re a low-risk client.

2. Control CSA Scores

- Avoid violations during roadside inspections.

- Keep your BASIC scores low — underwriters review these as a quick risk snapshot.

Example: Four different carriers recently reduced premiums in a high-cost year because their CSA scores stayed low, they had zero claims, and no violations on record. This is where good proactive safety management comes in.

3. Prevent Claims — Big or Small

- Even minor fender-benders affect your loss-run history.

- Cooperate fully with adjusters when claims occur.

- Avoid filing small claims that you can afford to cover yourself; they still impact your record.

4. Invest in Safety Technology

- Dashcams (road- and driver-facing) can protect you in disputed accidents.

- Some insurers offer discounts or even cover the cost of installation.

5. Show a Strong Business Plan

- Document maintenance schedules and safety procedures.

- Keep your CDL and business registration in the same state you reside in.

- Maintain good credit — it’s often part of the underwriting process.

6. Bundle Coverage Where Possible

- Using one insurer for multiple policies (auto, cargo, general liability) may qualify you for combined deductibles and multi-policy discounts.

What Can You Do Now?

High commercial auto insurance premiums aren’t going away anytime soon. But carriers and owner-operators aren’t powerless.

By keeping your record clean, controlling CSA scores, avoiding unnecessary claims, and demonstrating a commitment to safety and business stability, you can make yourself a more attractive — and less expensive — customer in the eyes of insurers.

At CNS Insurance, we specialize in helping trucking companies and owner-operators navigate these challenges, compare policy options, and build risk profiles that appeal to underwriters. A proactive approach today could mean thousands in savings when renewal time comes.

The worst situation to be in is getting bad commercial truck insurance coverage and being committed to it for a year when one accident can ruin your business.

Fill out a complete quote or quick quote to get started.

If you have any questions or concerns, please call us at 800.724.5523 or email info@cnsinsures.com.